Everyday Things That Are Shockingly Expensive Once You Become an Adult

No one warns you that the real shock of adulthood isn’t taxes but how expensive everyday life becomes. The things you once thought were small expenses suddenly start to drain your wallet. Prices gradually rise to the point where a single grocery trip feels like a financial workout.

Suddenly, budgeting becomes survival. Here’s a look at the everyday things that suddenly cost way more than you expected.

Groceries

Credit: Getty Images

There was a time when grabbing snacks on a whim felt easy. Now, a simple grocery run often ends with a bill near $100. Food prices in the U.S. have climbed more than 25% since 2020, and essentials like eggs and bread fluctuate with inflation. Fresh produce and quality protein that once felt practical now strain the budget. Even home cooking adds up faster than it used to.

Healthcare

Credit: Canva

A single urgent-care visit averages around $150–$400 without insurance, and dental cleanings can cost $70 to $250 each. Doctor visits, prescriptions, and dental checkups can quickly empty bank accounts. Insurance helps, but co-pays and unexpected treatments can cost shocking amounts of money.

Utilities

Credit: pexels

The power bill lands, then the water bill, then the internet and heat right behind it. They don’t pause or ease up, no matter how careful you are. Summer means watching the air conditioner spin the meter, and winter brings the same dread with the furnace. Even when you live alone, the costs stack up like you’re running a small household.

Transportation

Credit: pexels

The average car payment is now over $700 per month, and gas prices fluctuate between $3 and $5 per gallon. Public transport or rideshares might look cheaper, but they add up, too. Getting around is never truly “cheap.”

Household Stuff

Credit: pexels

It’s never one big expense, just a slow drip of small ones. Toilet paper runs out the same week as detergent, and suddenly the lightbulbs give up too. You restock, tell yourself it’ll last, and then something else breaks. Even replacing a chair or fixing a shelf can throw off your budget for the month.

Clothing

Credit: pexels

Investing in quality fabric, appropriate shoes, work clothes, winter coats, ties, socks, and underwear is a significant expense. Even a basic professional wardrobe can easily exceed $1,000, and shoes wear out faster than you expect. We all thought we would be fashionable when we grew up. It turns out that adulthood is about surviving at the crossroads of function and price tags.

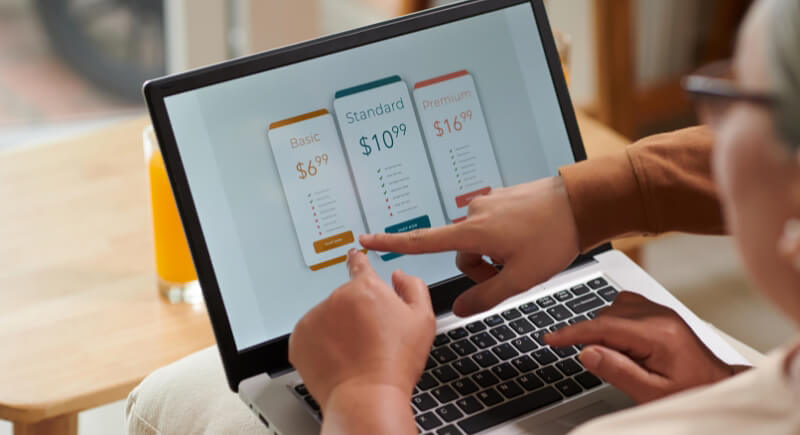

Subscription Services

Credit: Canva

It often begins with one streaming app, then a music plan, then a fitness subscription you forget to cancel. Add cloud storage, news access, and a few low-cost apps, and the total quietly grows. By 2025, the average person was spending around $270 each month on subscriptions, many of which go unused or unnoticed. Those free trials always end up on the credit card bill.

Dining Out

Credit: pexels

It starts as a simple dinner with friends. Then come the drinks, dessert, tax, and tip. It all feels casual until you look at your bank statement and realize how fast it adds up. Those easy nights out can quietly take up half your food budget before the month is over.

Personal Grooming

Credit: pexels

Haircuts, shampoo, skincare, facials, massages, and other services can significantly impact your budget. Adult hygiene isn’t cheap. Add the occasional facial or salon visit, and you’ve spent more than expected. Looking decent now feels like a line item in your budget.

Gifts and Celebrations

Credit: pexels

Every month seems to bring another occasion. Events such as birthdays, weddings, or holiday gatherings often occur. The spending never really stops. Even small, thoughtful gifts or dinners add up before you notice.

Household Services

Credit: Canva

The to-do list at home grows faster than time allows. Cleaning, lawn work, pest control, small plumbing tasks, and some carpentry are tasks that used to be simple but are now often outsourced. Chances are that you are paying for them every month as a part of routine, not a luxury.

Technology and Gadgets

Credit: Canva

Tech has become a quiet drain. Phones need replacing, laptops slow down, and chargers disappear. Repairs and upgrades never end, and each one costs more than expected. While this expense can be reduced significantly, no one wants to be left behind in the race to acquire the latest gadgets.

Pets

Credit: Canva

Owning a pet sounds simple until the bills start rolling in. They bring joy every day, but they also stretch the budget. Food, vet visits, grooming, and the random toy that keeps them happy all cost more than expected.

Insurance

Credit: Canva

It’s the bill that never feels optional. Health, car, home, and life coverage all promise protection, but every policy cuts into your paycheck. You keep paying for peace of mind, knowing it only matters if something goes wrong. The safety feels distant; the cost doesn’t.

Fitness and Sports

Credit: pexels

Staying healthy shouldn’t cost this much, but here we are. Exercise used to mean a jog outside, but the truth is that staying active isn’t as effortless as it sounds. Gym fees, training classes, new shoes, and equipment keep stacking up.